The Only Institute in Hyderabad offering GST Practical Training on GST Portal with Real Time Client data. Don't lose your money for paying unauthorized institutes for GST, they will teach you about GST on Tally only. Learn from the Industry Experts only @ Capital Trainers

Everything you need to become a tax professional, in one GST course!

Our uniquely designed GST course has taught over 10,000 people how to prepare individual and small-to-medium business tax returns.

Our uniquely designed GST course has taught over 10,000 people how to prepare individual and small-to-medium business tax returns.

What will I get in this course?

Our complete GST Practical Course includes:

Our complete GST Practical Course includes:

- Introduction to GST

- Types of GST & Rate Structure under GST

- Exemption in GST

- GST Registration (Mandatory & Voluntary)

- Concept of Supply under GST

- Concept of Place of Supply

- Time of Supply & Valuation under GST

- Types of Invoices & Invoices Format

- Computation of GST

- Input Tax Credit

- Concept of Reverse Charge Mechanism

- Recordings GST Liability, ITC, Computation of GST Payment & Set off entry for ITC

- Filing of GST Returns - GSTR 1, GSTR 2, GSTR3B, CMP 08

- E-way bill Requirement & Compliance

- E-Invoicing

- Composition Scheme in GST

- Tax Computation, Payments & Reports

- TDS Under GST

- GST Annual Return GSTR-9, GSTR-9A

HOW TO PREPARE TAX RETURNS

Learn how to prepare GST returns for individuals and businesses:

Learn how to prepare GST returns for individuals and businesses:

- Prepare & File GST returns for different taxpayers and businesses

- Use specially formulated tax planning problems to get hands-on practice

- Test your skills with real-life case studies

- Learn how to devise tax-saving strategies for individuals & businesses

- Become a tax expert who can save clients significant sums in taxes

Enjoy the personal attention of a skilled CA professional tax instructor:

As soon as you enroll, you’ll be assigned a skilled instructor who will serve as your personal guide throughout the course. Your instructor will provide guidance, coaching, and any required review and remediation you may need to succeed. We pride ourselves in the quality of our personalized student attention.

As soon as you enroll, you’ll be assigned a skilled instructor who will serve as your personal guide throughout the course. Your instructor will provide guidance, coaching, and any required review and remediation you may need to succeed. We pride ourselves in the quality of our personalized student attention.

Get tested…and get your certificate!

Following each master unit, you’ll take a series of online, interactive examinations to reinforce your learning and monitor your progress. Your test results will be graded automatically, then carefully reviewed and notated by your instructor, who will follow up with detailed, personalized help on any of the topics covered.

Following each master unit, you’ll take a series of online, interactive examinations to reinforce your learning and monitor your progress. Your test results will be graded automatically, then carefully reviewed and notated by your instructor, who will follow up with detailed, personalized help on any of the topics covered.

What Is GST

GST is a single tax which will include many indirect taxes that are currently levied on sales of goods as well as services. This tax is comprehensive and will be levied on the manufacture, sale and consumption of many goods and services at the national level.

The objective of bringing GST is to consolidate many indirect taxes that are levied into one single tax. This would help to overcome several limitations that exist in the current indirect tax structure. In the end, tax administration will become a more efficient operation. Introduction of GST is a very significant step as it helps to amalgamate many central and state taxes into a single tax. This would help to do away with cascading double taxation and bringing a common national market into existence.

GST is a single tax which will include many indirect taxes that are currently levied on sales of goods as well as services. This tax is comprehensive and will be levied on the manufacture, sale and consumption of many goods and services at the national level.

The objective of bringing GST is to consolidate many indirect taxes that are levied into one single tax. This would help to overcome several limitations that exist in the current indirect tax structure. In the end, tax administration will become a more efficient operation. Introduction of GST is a very significant step as it helps to amalgamate many central and state taxes into a single tax. This would help to do away with cascading double taxation and bringing a common national market into existence.

Why GST Training

GST training is merely a thorough guide to the regulations of the Goods and Services Tax. The GST course in Capital Trainers covers all the practical aspects of GST that includes registration, the returns, accounting and recording of GST transactions.

GST training is merely a thorough guide to the regulations of the Goods and Services Tax. The GST course in Capital Trainers covers all the practical aspects of GST that includes registration, the returns, accounting and recording of GST transactions.

Who Are Best Candidates For GST Classes In Capital Trainers ?

Graduates and post-graduates in commerce, CA, CMA, CS Students & professionals, law, banking or business administration may take up the course. To apply for the GST Training classes in Capital Trainers, you can be a practicing tax consultant, accountant or an aspiring GST professional in any type of organization

Graduates and post-graduates in commerce, CA, CMA, CS Students & professionals, law, banking or business administration may take up the course. To apply for the GST Training classes in Capital Trainers, you can be a practicing tax consultant, accountant or an aspiring GST professional in any type of organization

Features of GST

- Basic Law

- Eligibility

- Registration

- Migration

- Filing GST Returns

- GST Refund

- Inputting Tax Entries

- Filling Forms

- Formats

Banking Matters

This module details all the responsibilities of the accounts department personnel with respect to transactions with the bank, BRS, all matters related to bank guarantees, LCs, and all other matters related to the finance department of the organization.

This module details all the responsibilities of the accounts department personnel with respect to transactions with the bank, BRS, all matters related to bank guarantees, LCs, and all other matters related to the finance department of the organization.

- Why GST

- Multiple taxes and cascading

- Compliance Procedures

GST Components

- SGST

- IGST

- CGST

- GST – Tax Structure

- Zero/Lower/Standard/Higher Rates

- Additional Cess

Benefits of GST

- Goods and their free movement

- Reduced Tax and Tax credit

- Automated compliance

- GST Registration

- Eligibility

- Documentation required

- GSTIN

- New Applicants and the registration process

- Existing Tax Payers and the Registration process

- Application – Status Checking

- Filing GST Returns

- How to receive input tax credits for GST services rendered

- Create GST Invoices for tax that is collected

- Create GST Returns

- GST Invoicing and Payments

- How to pay taxes

We are Registered UNDER MINISTRY OF CORPORATE AFFAIRS "Pasupuleti Training Institute for Computer Accountants Pvt. Ltd"

Why Capital Trainers?

- Get Trained from Expert CA's with 10+ Years of Experience

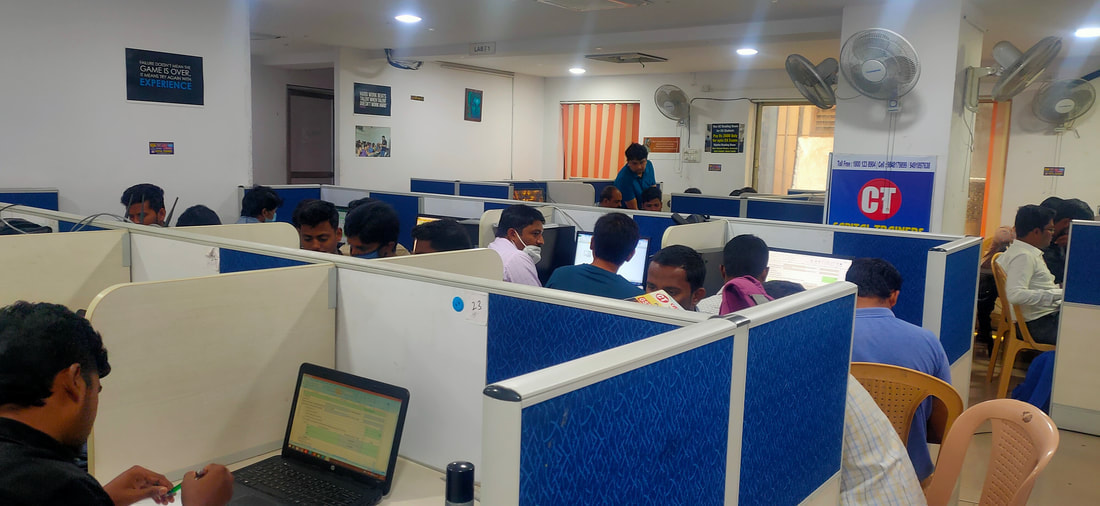

- 100% Practical Classes

- Assignment Based Training

- Study Material

- Real-Time Application of the Complicated GST Provisions

- Get Certified GST Practitioner Certification from a Govt Recognized Institute

- Dedicated Computer Lab

- 100% Placement Support

Class Room & Online GST Training Available. For more information feel free to talk to us on 9848179899, 9491897638. We will suggest career options also for you.

We Capital Trainers - Leading Training institute in Hyderabad for GST Practical Training