Income Tax & TDS

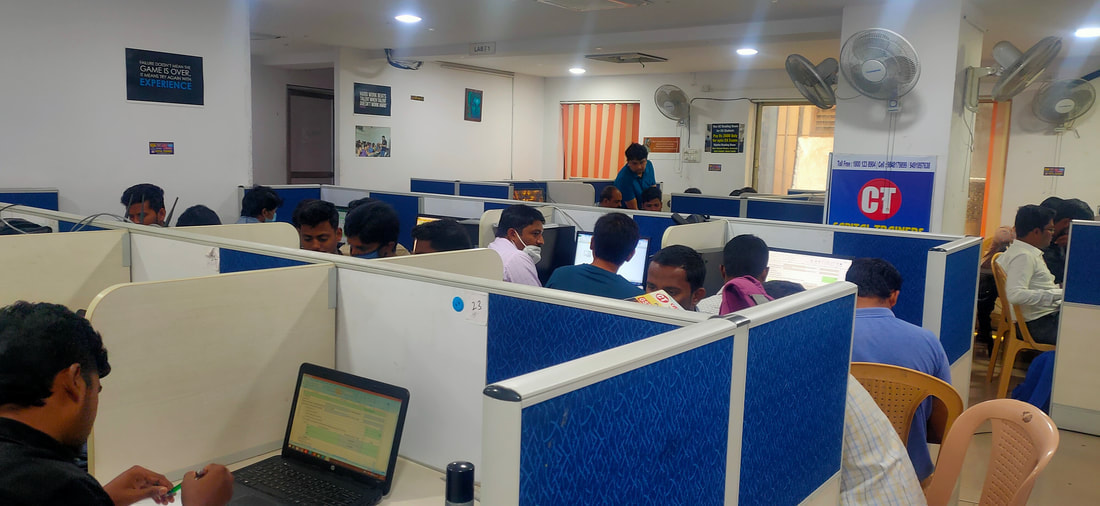

We are the Only Institute offering Real Time Practical Training on Income Tax Portal with Our Client data. Don't lose your money by paying to other institutes for learning about Income Tax, They just brief you about theory only. If your ambition is Filing Income Tax Returns on Your Own, You are at Right Place - Capital Trainers.

"Anybody Can File Income Tax Returns after this Training"

Learn Practical E Taxation

Capital Trainers offers Income Tax & TDS training in "Return preparation" online known as e filing of returns ITR 1, ITR 2, ITR 3, ITR4, ITR 5, ITR 6, ITR 7 & TDS.

Our taxation training Course helps you to find better job opportunities or you can become Tax Consultant/ Tax Advisor or become tax practitioner. In this course student will Learn how to file online ITR & TDS Returns under the guidance of Chartered Accountants. Students learn how to prepare and file e return to deal with taxation matters with confidence . Capital Trainers offers this course by keeping all the practical aspect of subject. This course provides practical taxation training with the help of qualified CA faculties. And professional guidance on subject matter by trained and experienced faculties. With the help of this course student can prove his ability before employer for gaining a high paid job.

There are many students who wan to know how to become tax consultant ? Our Course can be helpful for them to become a Tax Advisor. Those Students who are interested to become consultant and start their own consultancy by preparing returns can join this course. Income Tax Training Course is important and career oriented that opens many job prospects. Upon successful completion students can look for job with various organisation and professional consultants and Chartered Accountants to further improve their skills.

Capital Trainers offers Income Tax & TDS training in "Return preparation" online known as e filing of returns ITR 1, ITR 2, ITR 3, ITR4, ITR 5, ITR 6, ITR 7 & TDS.

Our taxation training Course helps you to find better job opportunities or you can become Tax Consultant/ Tax Advisor or become tax practitioner. In this course student will Learn how to file online ITR & TDS Returns under the guidance of Chartered Accountants. Students learn how to prepare and file e return to deal with taxation matters with confidence . Capital Trainers offers this course by keeping all the practical aspect of subject. This course provides practical taxation training with the help of qualified CA faculties. And professional guidance on subject matter by trained and experienced faculties. With the help of this course student can prove his ability before employer for gaining a high paid job.

There are many students who wan to know how to become tax consultant ? Our Course can be helpful for them to become a Tax Advisor. Those Students who are interested to become consultant and start their own consultancy by preparing returns can join this course. Income Tax Training Course is important and career oriented that opens many job prospects. Upon successful completion students can look for job with various organisation and professional consultants and Chartered Accountants to further improve their skills.

Program Highlights

- Introduction to Income Tax

- Residential Status of an assesse,Various Heads of Income including Salary, Income under the head House Property, Profit & Gains from Business and Profession, Income from Capital Gains & other Sources.

- Income under head PGBP (corporate exposure) Real time calculation

- Presumptive taxation u/s 44AB, AD, AE

- Deduction from Income Deduction u/s 80c to 80u

- Clubbing of income & Set off and carry forward of losses.

- Introduction to Income Tax portal & E Filing of Income Tax Returns

- Returns of Income u/s 139 from ITR-1 to ITR-7 for all assesse

- Agriculture Income

- Advance Tax

- Interest u/s 234A,B,C

- Income Tax notice and Scrutiny Cases under section 143

- E TDS return online

- Form 3CD Tax Audit procedure and laws practical training

The Following IT Returns will be discussed in our Course

For Individuals being a Resident (other than Not Ordinarily Resident) having Total Income upto Rs.50 lakhs, having Income from Salaries, One House Property, Other Sources (Interest etc.), and Agricultural Income upto Rs.5 thousand(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares)

For Individuals and HUFs not having income from profits and gains of business or profession

For individuals and HUFs having income from profits and gains of business or profession

For Individuals, HUFs and Firms (other than LLP) being a Resident having Total Income upto Rs.50 lakhs and having income from Business and Profession which is computed under sections 44AD, 44ADA or 44AE

(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares)For Individuals, HUFs and Firms (other than LLP) being a Resident having Total Income upto Rs.50 lakhs and having income from Business and Profession which is computed under sections 44AD, 44ADA or 44AE

(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares)

(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares)For Individuals, HUFs and Firms (other than LLP) being a Resident having Total Income upto Rs.50 lakhs and having income from Business and Profession which is computed under sections 44AD, 44ADA or 44AE

(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares)

For persons other than:-

(i) Individual,

(ii) HUF,

(iii) Company and

(iv) Person filing Form ITR-7

(i) Individual,

(ii) HUF,

(iii) Company and

(iv) Person filing Form ITR-7

For Companies other than companies claiming exemption under section 11

For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D)

- TDS Payment

- TDS Returns Filing

For Admissions:

Capital Trainers

#F1, 1st Floor, KVR Enclave,

Above ICICI Bank,

Near Gurudwara, Ameerpet,

Hyderabad 500016

9848179899, 9491897638

Capital Trainers

#F1, 1st Floor, KVR Enclave,

Above ICICI Bank,

Near Gurudwara, Ameerpet,

Hyderabad 500016

9848179899, 9491897638

We are Registered UNDER MINISTRY OF CORPORATE AFFAIRS "Pasupuleti Training Institute for Computer Accountants Pvt. Ltd"